The Facts About Financial Education Uncovered

Wiki Article

Examine This Report about Financial Education

Table of ContentsFinancial Education for DummiesHow Financial Education can Save You Time, Stress, and Money.Fascination About Financial EducationThe Single Strategy To Use For Financial EducationThe 2-Minute Rule for Financial Education

Don't be worried! As your kids age, share your personal experiences and also the cash lessons you found out, for better or for even worse. If you've had issues sticking to a budget plan or entered credit-card financial debt, be sincere with your teenager about your bad moves so they can learn from your experience.While the details presented is believed to be valid and also current, its precision is not assured and it must not be considered a total evaluation of the subjects talked about. All expressions of point of view mirror the judgment of the author(s) as of the date of publication and also are subject to transform.

Donna Paris I am a writer living in Toronto and truly desire Mydoh was around when she was a kid. I can have found out a great deal concerning taking care of money. My number-one suggestion? Begin conserving as early as feasible, compound interest is a wonderful thing. Yet as I have actually additionally learned, it's never far too late to start saving!.

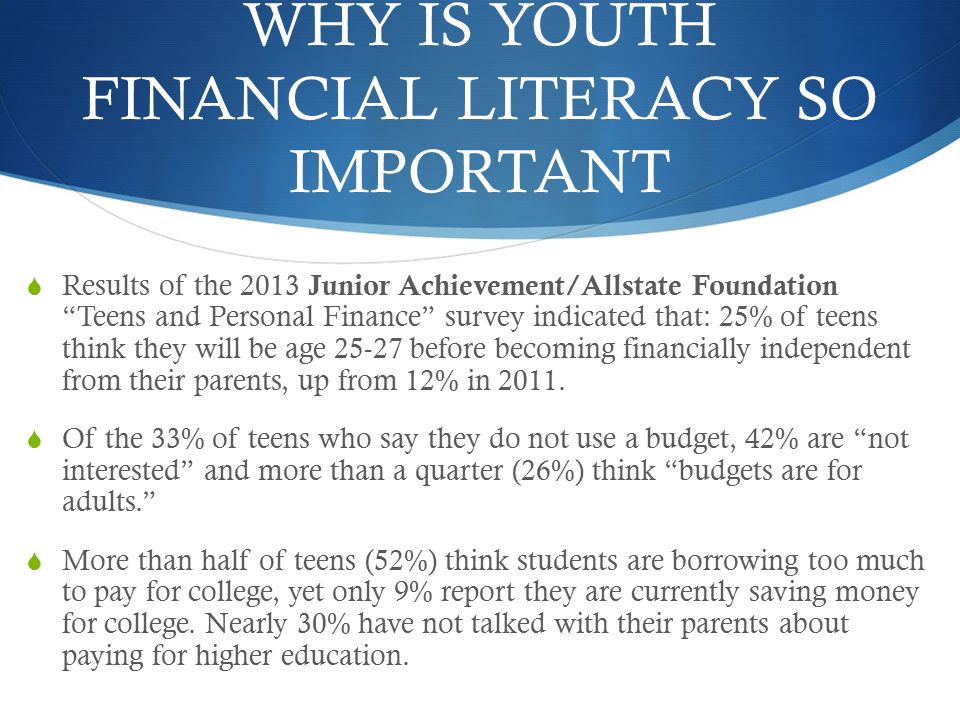

Cost savings rates are reducing while financial obligation is boosting, as well as incomes are remaining stationary (Best Nursing Paper Writing Service). College trainees that prioritize financial literacy will certainly have the ability to get rid of these obstacles and also live pleasantly in the future. Congress established up the Financial Proficiency and also Education And Learning Compensation under the Fair and also Accurate Credit Score Purchases Act of 2003.

The smart Trick of Financial Education That Nobody is Discussing

The Payment sought to accomplish this by developing a nationwide financial education and learning site, . Through the Payment's site, they developed five key monetary proficiency principles. One critical part of financial proficiency is the ability to generate income. Even a lot more than that, it's about the understanding of what occurs to the cash you make, consisting of: The amount you take house on your income The advantages your employer uses The quantity you pay in tax obligations and where that money goes It's specifically essential that young individuals discover this principle of monetary literacy early prior to they sign up with the labor force.Conserving is one of the most vital means to prepare for your economic future. This incorporates every little thing from exactly how to open a cost savings account to how to actually conserve cash.

The capability to invest intelligently is possibly one of the most important one to find out at a young age. Several youths get their first part-time job in secondary school or university however then have no economic obligations. Consequently, they can invest their cash on fun. While that's penalty at a young age, it doesn't necessarily develop the costs habits that will certainly assist them later on.

It also includes the capacity to live within your means and also make enlightened acquiring decisions. There's never a much better time to learn regarding the economic literacy principle of loaning than as a go now young individual.

Get This Report about Financial Education

It begins with learning about credit rating ratings as well as credit report reports, which are some of the most vital figuring out elements when it comes to using for debt. As soon as somebody has constructed up the monetary background to certify for financings and also credit, it's essential that they comprehend their funding terms, such as APR.About fifty percent of those with student financing financial obligation regret their choice to borrow as much as they did.

see this page Today, college-educated employees make roughly the very same as college-educated individuals carried out in previous generations, when you represent rising cost of living. However when you look at those with a partial college education and learning or none whatsoever, today's youngsters are making less than previous generations. Due to the fact that young people are making less cash, it's critical that they discover to handle it.

The Only Guide to Financial Education

If this pattern continues, it can be the situation that today's youngsters make the like and even less than their parents and grandparents did. Financial literacy is decreasing among young people at once when it's more essential than ever. As an university student, now is the time to locate means to raise your expertise of economic abilities as well as ideas.If it holds true that we're currently in a recession, it's possible that the stock exchange, along with income, might decrease, as firms make much less revenue and stock proprietors come to be a lot more risk-averse as well as want to other properties to shield or expand their riches. This is one reason it can be so advantageous to maintain a high degree of monetary literacy.

This is an additional factor to obtain going on your personal monetary educationthe earlier you get the fundamentals down, the faster you can make informed decisions. Even better, the sooner you have the essentials down, the faster you can expand your monetary education further and acquire also a lot more insight right into your distinct economic circumstance.

In a financial environment where analysts are talking about whether or not an economic crisis has started, now might be a fun time to start finding out, or learn much more, concerning personal financing, portfolio building, and also diversification. In the previous year, we have actually put plenty of hours of job right into making it simpler than ever before to access our huge library of post, special reports, video clips, and also much more.

The 20-Second Trick For Financial Education

To read more regarding the protective power of valuable metals, GO HERE to request a FREE copy of our Gold Information Kit.

This is so because youngsters have a very valuable present: time. The future benefits are larger the earlier your young person begins investing money. Due to the fact that money is made yearly from the profits of the previous year, this is the outcome of the magic of compounding, which leads to the boost of gains via the addition of interest to a primary amount of the down payment.

What monetary education and learning lessons can we give young individuals who just have accessibility to a few figures on a screen for cash? How can we introduce them to the relevance of monetary proficiency? Introducing our purposeful cash discussions as well as assumptions will prepare your teen for adulthood by outfitting them with the experience and also understanding they need to secure their funds as well as stay clear of costly errors.

Report this wiki page